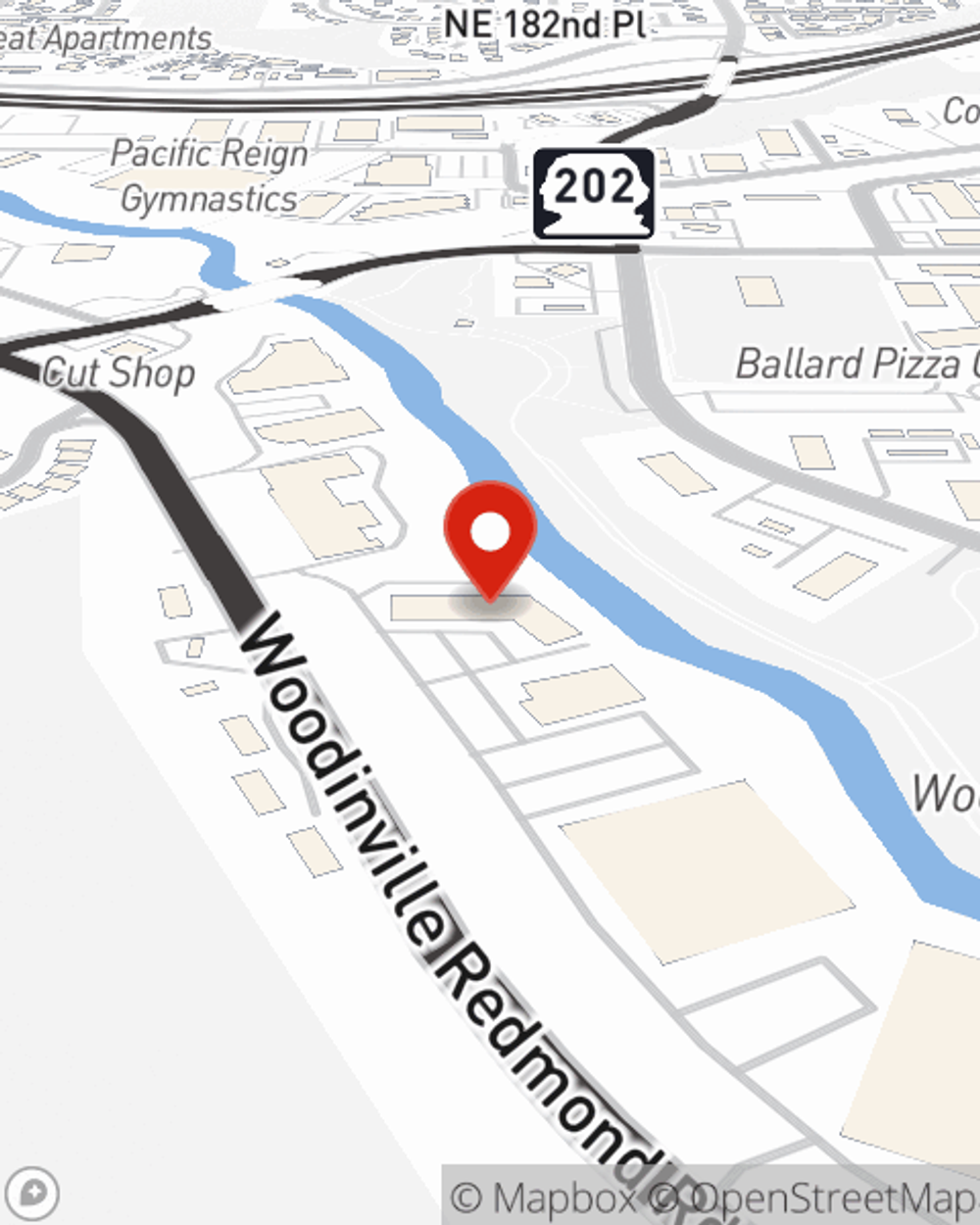

Business Insurance in and around Woodinville

Get your Woodinville business covered, right here!

Cover all the bases for your small business

- Washington

- Idaho

- Redmond

- Bothell

- Kirkland

- Monroe

- Snohomish

- Everett

- Bellevue

- Renton

- Tacoma

- Seattle

- Sammamish

- Issaquah

- Duvall

- Boise

- Coeur D Alene

- Hayden

- Spokane

- Kenmore

- Carnation

- King County

- Snohomish County

- Pierce County

State Farm Understands Small Businesses.

You've put a lot of blood, sweat, and tears into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a bakery, a photography business, a clock shop, or other.

Get your Woodinville business covered, right here!

Cover all the bases for your small business

Strictly Business With State Farm

Each business is unique and faces a different set of challenges. Whether you are growing a bridal shop or a travel agency, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your speciality, you may need more than just business property insurance. State Farm Agent Mike Rodgers can help with errors and omissions liability as well as commercial auto insurance.

Let's discuss business! Call Mike Rodgers today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Mike Rodgers

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.